The Basic Principles Of Transaction Advisory Services

Table of ContentsWhat Does Transaction Advisory Services Mean?The 7-Second Trick For Transaction Advisory ServicesThe Facts About Transaction Advisory Services UncoveredTransaction Advisory Services for DummiesThe 7-Minute Rule for Transaction Advisory Services

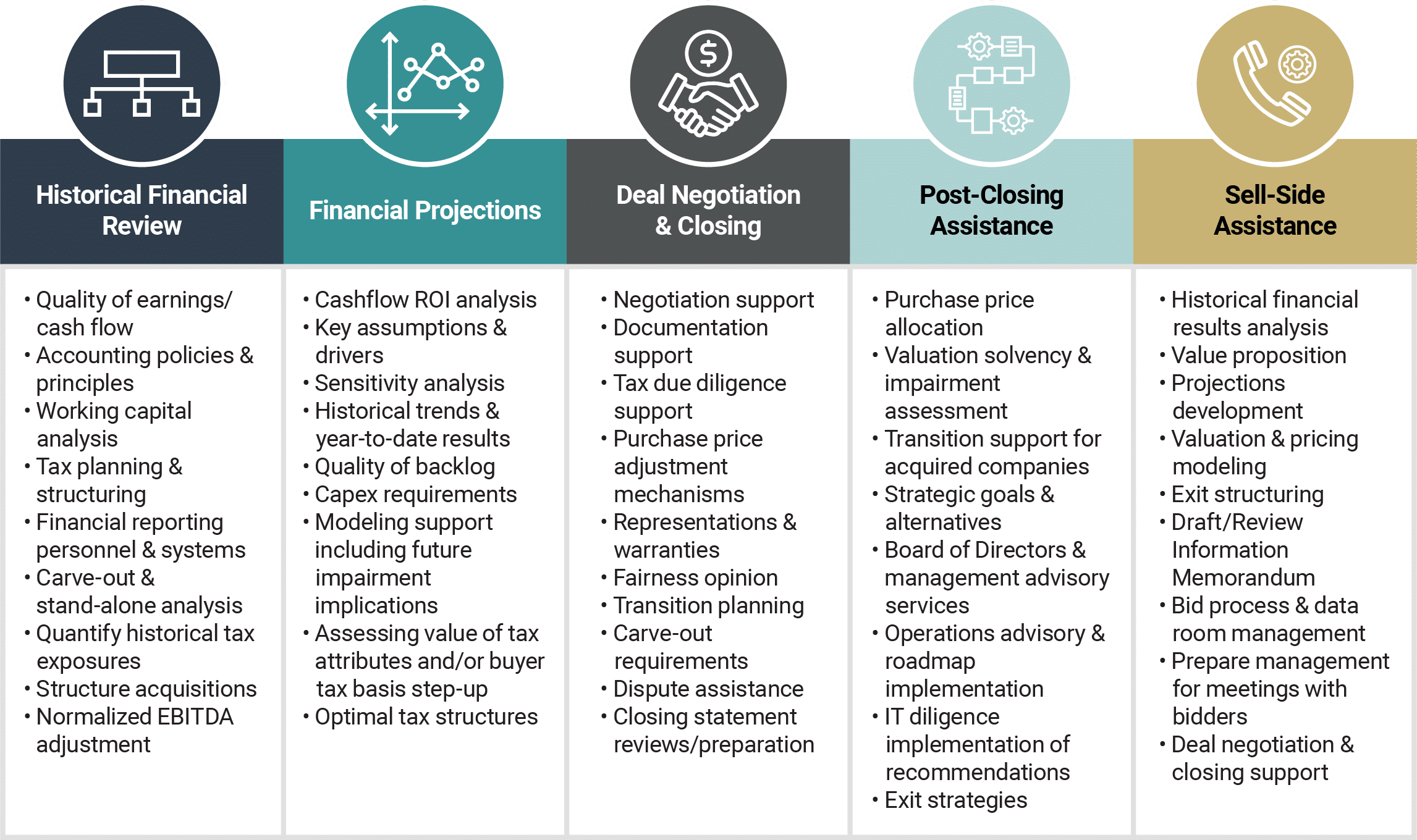

This step sees to it the organization looks its ideal to potential purchasers. Getting business's worth right is essential for a successful sale. Advisors utilize various methods, like reduced cash money circulation (DCF) evaluation, comparing to comparable companies, and recent transactions, to determine the fair market price. This helps establish a fair cost and discuss successfully with future customers.Purchase consultants action in to assist by obtaining all the required info organized, answering questions from purchasers, and setting up sees to the business's area. This constructs count on with customers and keeps the sale moving along. Obtaining the ideal terms is crucial. Deal advisors utilize their knowledge to help entrepreneur take care of tough arrangements, fulfill customer assumptions, and structure bargains that match the proprietor's objectives.

Fulfilling lawful regulations is critical in any kind of service sale. Deal consultatory services deal with legal professionals to create and evaluate agreements, contracts, and other lawful papers. This lowers dangers and makes certain the sale complies with the legislation. The duty of deal advisors expands past the sale. They assist company proprietors in planning for their next steps, whether it's retirement, starting a new venture, or managing their newfound wide range.

Deal experts bring a wide range of experience and understanding, guaranteeing that every facet of the sale is managed properly. With strategic prep work, appraisal, and settlement, TAS assists entrepreneur achieve the greatest feasible sale rate. By guaranteeing lawful and governing compliance and managing due persistance along with various other bargain group participants, deal advisors decrease prospective risks and liabilities.

The Ultimate Guide To Transaction Advisory Services

By comparison, Large 4 TS teams: Work with (e.g., when a possible purchaser is performing due diligence, or when a bargain is shutting and the buyer requires to integrate the firm and re-value the vendor's Annual report). Are with costs that are not connected to the bargain shutting efficiently. Make charges per engagement somewhere in the, which is less than what investment financial institutions earn also on "small deals" (yet the collection possibility is likewise much greater).

, yet they'll focus more on audit and assessment and less on subjects like LBO modeling., and "accounting professional just" subjects like test equilibriums and how to stroll through occasions making use of debits and credits rather than economic statement modifications.

10 Simple Techniques For Transaction Advisory Services

that demonstrate exactly how both metrics have actually changed based upon items, channels, and customers. to judge the accuracy of management's previous forecasts., including aging, stock by product, ordinary degrees, and arrangements. to identify whether they're totally imaginary or somewhat credible. Experts in the TS/ FDD teams may additionally speak look at this web-site with management concerning whatever above, and they'll write a comprehensive record with their findings at the end of the procedure.

The hierarchy in Purchase Solutions varies a little bit from the ones in investment banking and exclusive equity jobs, and the general form looks like this: The entry-level role, where you do a whole lot of information and economic evaluation (2 years for a promo from here). The following level up; comparable job, but you obtain the even more fascinating little bits (3 years for a promo).

In specific, it's difficult to get advertised past the Manager level because couple of people leave the work at that phase, and you require to begin revealing proof of your capacity to create income to development. Allow's begin with the hours and way of living since those are easier to explain:. There are periodic late nights and weekend job, but absolutely nothing like the frenzied nature of financial investment banking.

There are cost-of-living changes, so official site expect lower settlement if you're in a less expensive location outside major financial (Transaction Advisory Services). For all settings other than Partner, the base income consists of the bulk of the overall compensation; the year-end bonus may be a max of 30% of your base pay. Frequently, the very best method to increase your incomes is to switch to a different firm and work out for a higher wage and benefit

All About Transaction Advisory Services

You can enter into business development, but investment financial obtains harder at this phase since you'll be over-qualified for Analyst roles. Corporate financing is still a choice. At this phase, you ought to just remain and make a run for a Partner-level duty. If you intend to leave, possibly move to a customer and execute their valuations and due diligence in-house.

The major trouble is that because: You generally need to sign up with one more Large 4 group, such as audit, and job there for a few years and afterwards relocate into TS, work there for a few years and after that move right into IB. And there's still no warranty of winning this IB duty because it depends upon your region, customers, and the employing market at the time.

Longer-term, there is likewise some danger of and since evaluating a business's historical financial info is not click here to find out more specifically rocket science. Yes, human beings will certainly always require to be entailed, but with advanced technology, reduced headcounts can potentially support customer engagements. That stated, the Purchase Services team defeats audit in terms of pay, job, and exit possibilities.

If you liked this post, you could be thinking about analysis.

Transaction Advisory Services - Questions

Develop advanced economic structures that assist in identifying the actual market value of a firm. Supply advising operate in relationship to service appraisal to aid in negotiating and prices frameworks. Describe the most appropriate kind of the deal and the type of factor to consider to employ (money, stock, gain out, and others).

Perform assimilation preparation to figure out the process, system, and business modifications that might be required after the deal. Set standards for incorporating divisions, modern technologies, and service processes.

Recognize prospective decreases by decreasing DPO, DIO, and DSO. Evaluate the possible customer base, industry verticals, and sales cycle. Consider the possibilities for both cross-selling and up-selling (Transaction Advisory Services). The functional due diligence offers essential understandings into the functioning of the firm to be obtained worrying risk assessment and value production. Identify temporary alterations to finances, financial institutions, and systems.